| 251GW | BNEF’s mid estimate of PV build in 2022 |

|---|---|

| 38% | New build solar growth in 2022 over 2021, mid scenario |

| 53% | Growth in global polysilicon production in 2022 over 2021 |

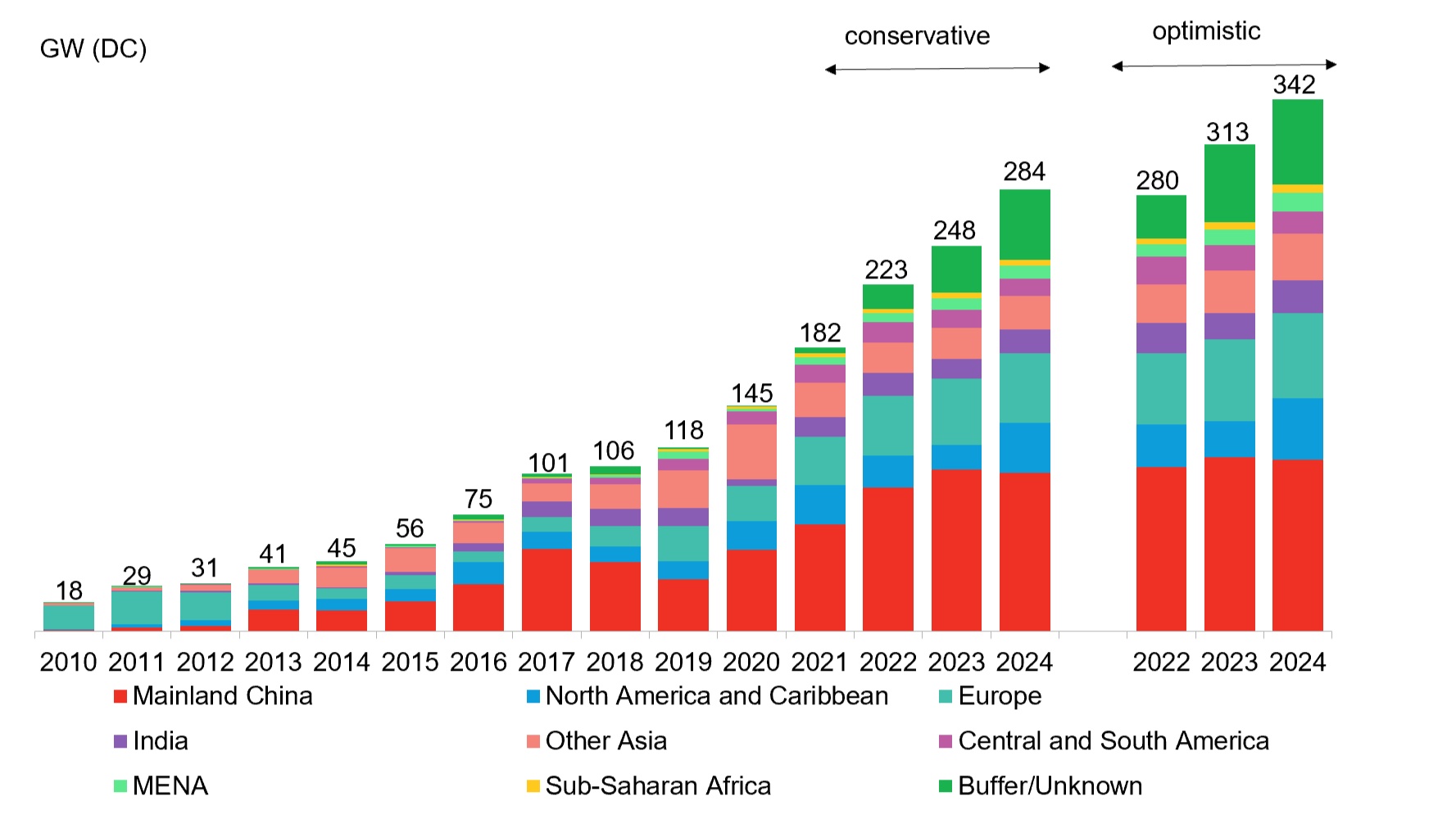

Historic and forecast global PV new build

- Polysilicon is still the global bottleneck for solar build, with the price hitting its highest level since October 2011 this month. The price, and large volume of exports reported by China, suggest that global demand for solar panels is much stronger than official statistics indicate.

- It is likely that the self-consumption segment of the solar market, which is poorly reported, is booming due to high energy prices in many markets and buyers aiming to hold more inventory to mitigate future supply chain disruption.

- Polysilicon production is ramping up rapidly, with enough expected to be made in 2022 to make 328 gigawatts (GW) of modules, and enough in 2023 to make 540GW of modules. We do not anticipate build will grow this fast, however, due to limits to growth in installation labor, grid connection and site permissioning. We expect at most 313GW of new build in 2023.

- The return to polysilicon oversupply could drop prices to around $15 per kilogram (kg) in 2023, and below $10/kg in 2024. At $15/kg, the cost of making modules would be 6.5 US cents lower than today, so we anticipate module prices will drop to 22 US cents per watt (W) by the end of 2023.

- The label for 2010 in Figure 1 and Figure 2 on pages 1 and 3 has been corrected.

Source : BNEF

Created on:2022-09-01 13:48